This article about teaching kids about money was last updated in 2022.

Have you ever wondered how to teach your children about money?

Lessons about money should be taught at school. How to understand it, value it, save it, make it. It’s a vital life tool. Yet many children enter adulthood with limited resources to help them deal with their dollars. It’s like we expect them to have money knowledge genetically built into them.

Whether we like it or not, our children learn by mirroring us. We unconsciously pass our limiting beliefs about money onto them, as they were passed to us from our parents. According to Think Money:

“These are the beliefs that have kept families at the same level of financial success for dozens, if not hundreds of years.”

It’s interesting to think our financial principles are already moulding our children’s future financial success. Interesting, and a little bit scary.

As a single mum the lessons you indirectly teach may be good or bad. It is important for our children to see us work for our money so they learn the basic process of where it comes from. Yet, if their lives are highly restricted due to lack of money or they live amid stress caused by money, the lessons can be negative. This personal impact of money and how it affects their little world is something no classroom, text book or website can teach.

Whatever your situation, there are ways you can teach your children about money as they grow-up. The best lessons are the subtle ones they learn from real life situations . And, if learnt from an early age, these messages will stay with them and help them enormously later in life.

So, if you’re concerned your child is growing up still thinking the money tree is alive and thriving at the end of your garden, try a few of these suggestions.

HOW TO TEACH YOUR CHILDREN ABOUT MONEY

TEACH THE TRUTH ABOUT MONEY

Be honest with your children about money. Make it clear we all need money to live and its right to want to have money. Tell them that money can’t buy happiness but it can make life more comfortable and it gives us choice and opportunity. They will work it out themselves eventually, so don’t confuse them with mixed messages.

SHOW THEM THE MONEY

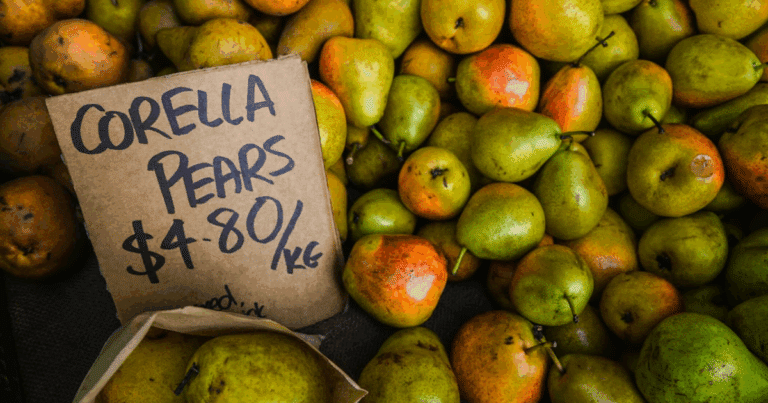

If children see you pay for everything with cards, they don’t appreciate the cost as much. When possible, especially with bigger items, try to pay in cash. Show them the money and let them hand it over. This simple action can make the value of money fall into place for them. For younger children, simply let them put the coins in the parking meter for a simple ‘touch and feel’ lesson.

EXPERIENCE THE CONSEQUENCE OF OVER-SPENDING

If your child spends their money allowance and wants more, it doesn’t always help to oblige. Let them learn to cope without money due to their own spending habits. If they have a mobile phone teach them to track their usage. And if they run out before the end of the billing period, don’t top them up straight-away. Let them deal with the consequences. They will learn much quicker!

MORE WAYS TO TEACH YOUR CHILDREN ABOUT MONEY

LAUGH ALL THE WAY TO THE BANK

If your child still thinks a bank is a grassy hill for rolling down, it could be time to explain why and how we utilise banks. Most banks allow children to open an account at the age of 12. Let them to do so and explain about interest and non-withdrawal bonuses. Plus, they can learn to use an ATM and online banking to track their money. These are all life skills for any budding bank-goer.

INPIRE THEM TO BE SAVVY SAVERS

Explain how to save money and let them experiment with their own pocket money. When they reach their savings goal make a big deal of it or give them a little more money as a bonus. Also let them see you save money. Tell them what you are saving for and why. They can watch and learn. This works especially if they’re interested in your savings goal, something like their birthday party for example. Good saving habits learnt early can reduce credit card crisis later in life.

GIVE THEM THE ONLINE SHOPPING LOWDOWN

Whether shopping intentionally or using an app or game that requires payment, your children must be well-informed about online shopping. Explain about scams and competitions. And tell them that if it looks too good to be true, then it probably is. Advise them never to enter payment details unless they are 100% sure what they are buying and that it’s from a secure source. Once they’re online, this is one of the most important lessons to teach your children about money.

MAKE THEM WORK!

Allocating chores to children is a very personal choice. The level of household help we expect from our children varies from parent-to-parent. Yet choosing age-appropriate jobs for your children and paying them for doing them is a great way to teach your children about money … they are never too young to revel in the satisfaction that comes from earning money. Use the brilliant Spriggy app to record chores and amount to be paid for each. My kids loved Spriggy when they were younger and, as young teens, they both have part time jobs they are dedicated to.

LET THEM HAVE FINANCIAL FUN

Younger children can learn about money under the pretext of having fun. Money learning resources come in many forms. Try MoneySmart Teaching which has games for varying age-groups or check out 7 Apps to Teach Your Kids Personal Finance Skills. And don’t disregard good old-fashioned board games like Show Me The Money, Pop To The Shops and Monopoly.