How you do pocket money with your kids is a personal thing. But sometimes this gleeful little allowance can get a tad complicated. I speak from experience!

If you’d like an easy way to keep yourself and your child on track with pocket money, an app could be the answer.

A pocket money app is a great way to help your child learn about earning money, saving and reaching financial goals. And, if your kids are like mine and love anything app/device/phone related, they’ll love learning via an app.

I’ve checked out the most popular pocket money apps available and provide a run-down on seven of the best.

Further reading: How to do pocket money for kids the right way.

7 Pocket money apps for kids and parents

iAllowance

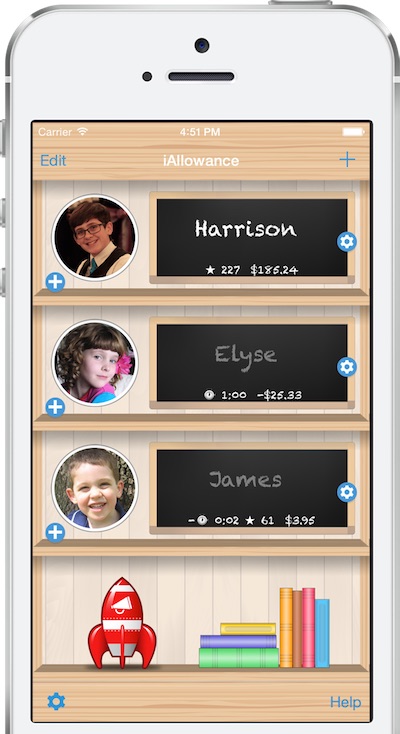

I remember using the iAllowance app when my kids were younger. They have since graduated to other pocket money apps, but I still recommend iAllowance to other parents looking for an easy-to-use reward tracking/money saving app, especially if your family is an iOS user.

What I like best about iAllowance is the value for money. It’s one of the cheapest pocket money apps on the App Store and the most powerful. You get chores/reward tracking, automatic allowance payment, push reminders, local backup, data export, and auto sync. It also has different themes for parents, including dark mode. It supports unlimited users and unlimited bank accounts.

The website says that iAllowance is responsible for over 30 million chores completed and 20 million allowances paid!

Free version: No

Cost: $2.99

Pros: Affordable, powerful financial management app for parents and kids, fun and easy to use

Cons: No web or Android version

You will love this app if: Your are an iOS user looking for a solid, easy to use pocket money app.

Kit Pocket Money App

One of my kids prefer using the Kit app to track daily chores and pocket money. We’re both pretty happy with it. She likes checking off her to-do list and enjoys the stories and fun characters in the app. She also uses this to track her savings.

It’s super easy for me to see what’s going on and I feel that transactions are secure. For example, I can track spending and even block some shops. I love that the pocket/spending money and savings (Stacks) are separate. You also get the exact amount paid automatically in your spending account.

I recommend the Kit app for younger kids. It’s built with children in mind as you can see from the design and navigation. It’s easy to use, colourful, and very visual. Each “lesson” is designed to be short and fun. My child who has a short attention span can sit through an entire story. And she loves the jokes!

Kit comes with a digital and physical prepaid card that your child can use. If you don’t have a Kit account yet, make sure to sign up this month. Be the first 1000 new users to sign up between 1-30 November 2022 and get $15 (terms apply). Registration is free.

Free version: Yes

Cost: Free

Pros: Fun and educational money-saving/reward-tracking tool

Cons: Android version in the works

You will love this app if: You have younger kids who want to learn money management.

Spriggy

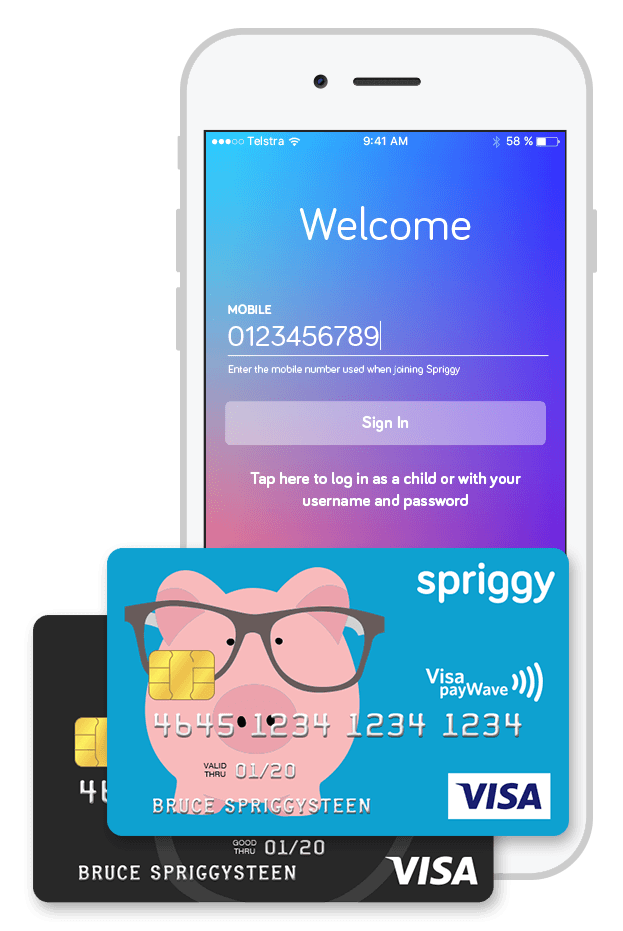

Having tried a lot of pocket money apps with my daughters, all of which have pros and cons, Spriggy is the one we use long-term. In fact my eldest only stopped using it when she turned 15.

It’s the most popular app in Australia, with good reason. It’s an all-in-one financial literacy tool for kids and a great way for us parents to encourage independence. Never mind the kids, I loved using this app.

The feature-packed app lets parents automate pocket money payments for all children, set jobs and savings goals, monitor spending history and send money instantly in an emergency … like when they’re out with their mates and want an ice cream but don’t have enough money in their account – this has happened.

The app is easy-to-use and child orientated but is part owned by NAB so has a hint of serious banking and feels secure.

Thanks Spriggy for bringing in the bank card for the older kids (without the pig on the front). It definitely gives Spriggy longevity because teens are happy to keep using it.

Free version: First month free

Cost: $30/child per year

Pros: All-in-one pocket money and financial literacy app for families

Cons: Pricey if you have a large family

You will love this app if: You want to manage and track your family’s finances from one place.

Hyperjar

My friend has great things to say about Hyperjar, a pocket money app that gives parents more control over their children’s spending. She’s a fan of the single account feature. There’s no separate app for kids, and the kids account is always paired with the adult account.

Kids do have their own prepaid card that mum or dad can top up. This easy-to-use pocket money app also lets parents track where and when they spend it from the main Hyperjar app. Kids can track their balance and spending on their own Hyperjar ap, but they’ll never overspend or access your bank account directly.

Other features she likes: You can set different “saving jars” for specific goals like food, entertainment, school and more (you get unlimited jars). This is a great way for kids to learn about budgeting, saving, spending wisely and planning finances for the future.

Free version: Free

Cost: Free

Pros: Free pocket money app, no subscription, loading or transaction fees

Cons: You need the main (separate) Hyperjar app to monitor kids’ spendingYou will love this app if: You want a completely free pocket money app with zero transaction fees.

Best pocket money app Australia

Famzoo

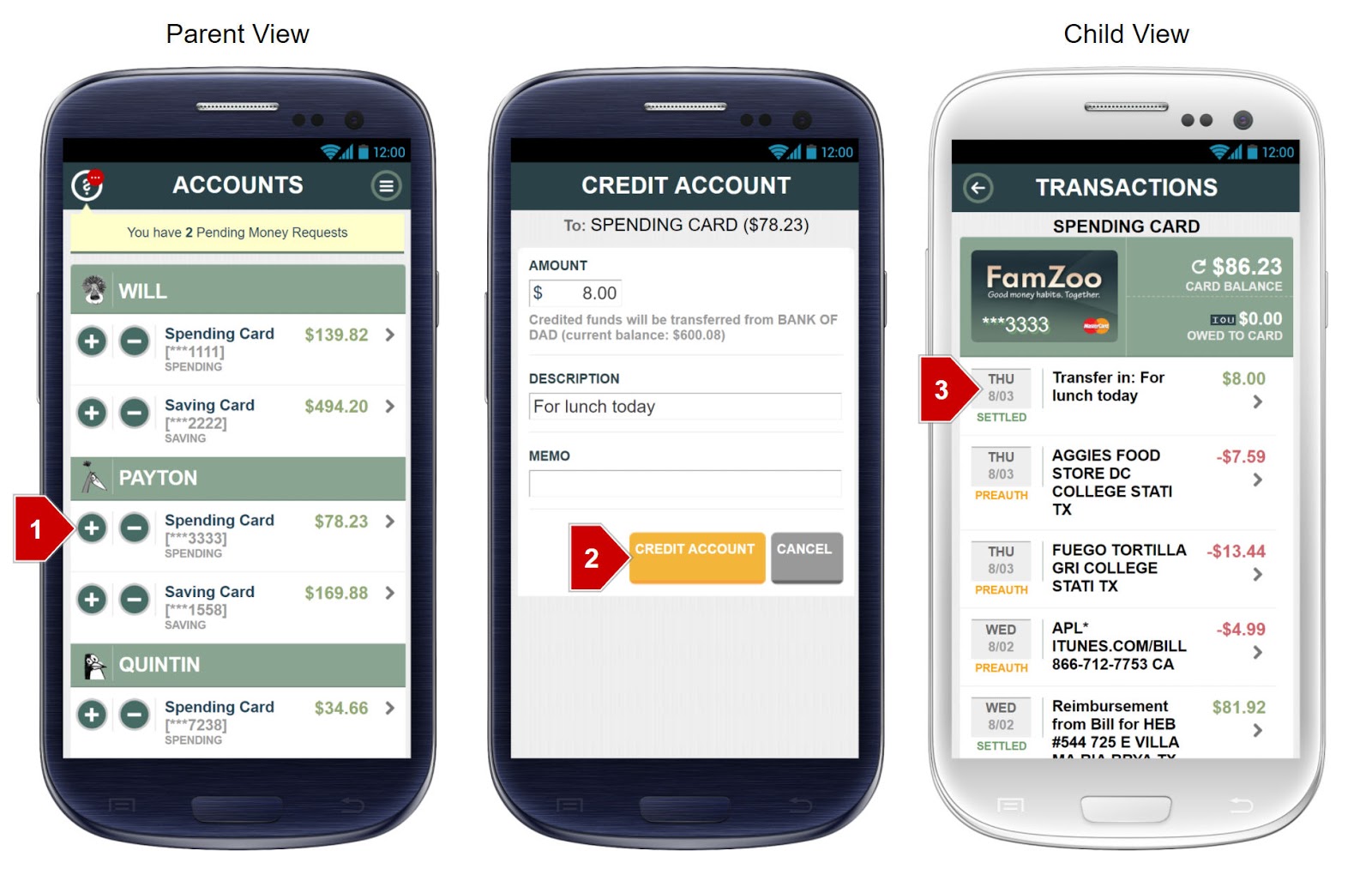

I’ve been looking at pocket money apps specifically designed for teens and university students, and Famzoo is the one that I’ve heard other mums recommend. I haven’t been using it long, but my experience has been good so far. Famzoo is perfect if your have older or college-bound kids, although it also works for preschool children.

Famzoo is basically an “online family bank” and a one-stop shop for the entire family’s online banking needs, whether it’s prepaid cards for the kids, tracking cash flow in real life, monitoring allowances or donating to your kids’ favourite charities.

For younger kids, you can start with reward charts and to-do lists for, then add features like prepaid cards and allowance management as they grow and become more financially responsible. They can learn about saving and budgeting in the app, and they can also pay parents for things like mobile data plans and penalties for not completing chores.

Free version: Free 30-day trial

Cost: Starts at $2.50/month (prepaid 24 months subscription)

Pros: Same price for all family sizes, feature-packed, kids can pay parents

Cons: Can be pricey ($5.99/month) if you chose the monthly subscription

You will love this app if: You need a complete virtual bank + financial literacy app for the whole famiy.

Bankaroo

My younger child’s friend uses the pocket money app Bankaroo as a virtual piggy bank and she seems to like it. I tried out the free version and was impressed by the features. The basic app is perfect for families who are just getting started with financial management.

You can use Bankaroo on any device and it’s available online and off. It’s easy to use and has fun educational features to help kids manage their allowance and become more financially responsible. Children as young as five can use Bankaroo to save money, earn interest on it, and get badges by completing goals.

I find Bankaroo very safe because parents can access their kids’ accounts and monitor money coming in and going out. More advanced features like checking, charitable donations, and money transfer between accounts can be unlocked by paying a one-time fee of $4.99.

Free version: Yes

Cost: $4.99 (Bankaroo Plus)

Pros: Kid-focused pocket money app with chores/reward tracking, used in schools nationwide

Cons: Money transfer is only available on the paid version

You will love this app if: You are a teacher or parent who needs a free basic financial literacy tool for kids age 5 to 13.

Zaap

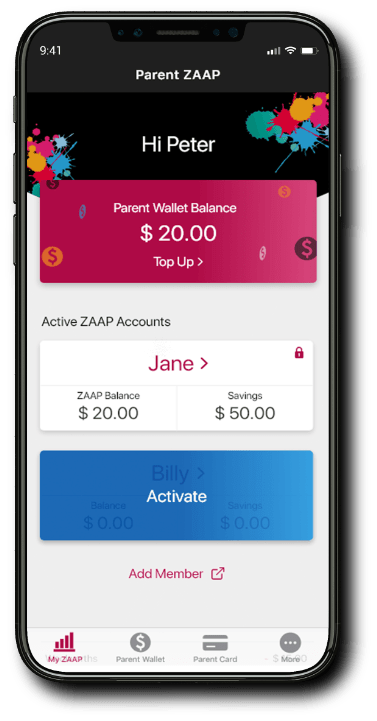

I haven’t personally used the Zaap app, but it’s a good option if you are looking for a paid pocket money app to streamline allowances for your family. Zaap combines multiple financial tools in one to make allowance management as painless as possible for both parents and kids.

The Zaap app comes with a prepaid MasterCard for cashless shopping or an optional wearable band. I like that kids can design their own card. Parents can track spending and savings, transfer money to your child’s card at any time, and teach your kids responsible money management. Don’t worry, your kids can only spend what is on the card and they can’t spend it on games or adult sites. You can always check where their allowance is going from your account.

One downside for me is the fee. There’s a $2 monthly fee per child and a load fee of 1.5% on top of that, which can get expensive if you have a large family.

Free version: Yes, free basic version

Cost: $2 per child per month (Zaap MasterCard)

Pros: Your kids’ own prepaid MasterCard for cashless shopping

Cons: Each top up costs 1.5% of load value, can be expensive for large families

You will love this app if: You need a pocket money app with a prepaid card for your kids’ purchases